4X Your Trading Power with

Margin Trading Facility

TRADE Now, Pay LATER!

Why lock up your funds when you can trade with ease and pay later?

Integrated's Exclusive Margin Trading Facility (MTF)

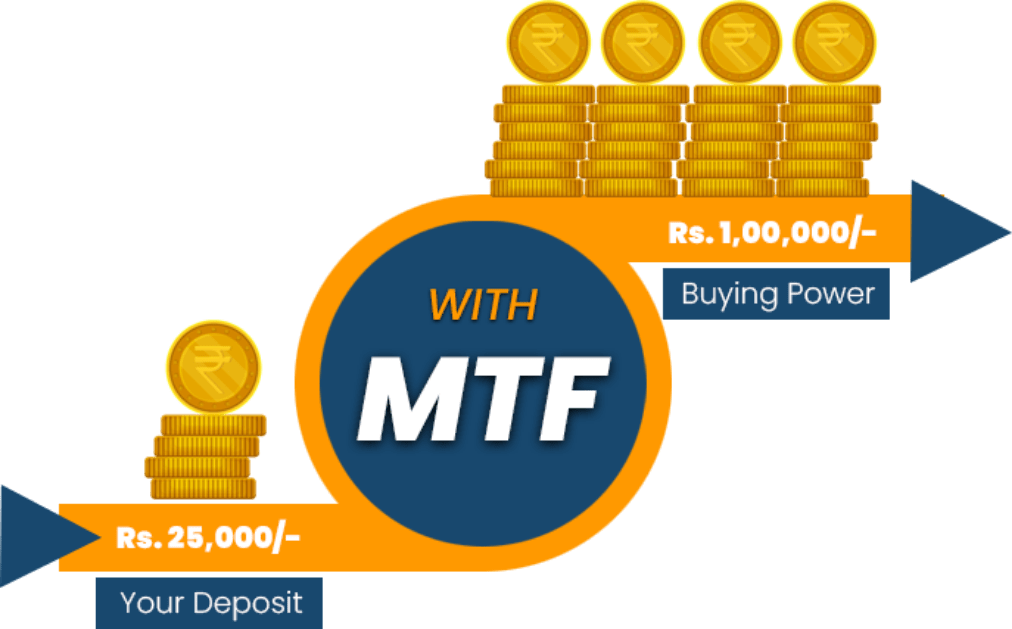

Integrated offers an exclusive Margin Trading Facility (MTF) for its customers, enabling them to enhance their buying power by up to 4X. With this facility, a customer with a credit balance of ₹25,000 can purchase stocks worth up to ₹1 lakh.

No T+6 Liquidation: Unlike traditional systems, customers can hold their positions as long as they cover any mark-to-market losses.

Competitive Interest Rate: Enjoy an interest rate of just 0.052% per day on the funded portion, with interest debited on a weekly basis.

Empower your investments and enjoy greater flexibility with Integrated's MTF!

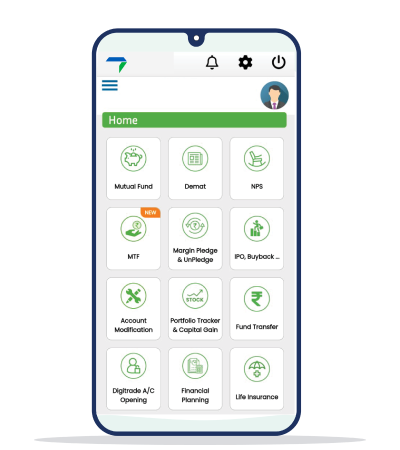

MTF Simplified with Integrated

Eligible Stocks

All Category 1 stocks listed on the NSE qualify for this facility.

How to Trade Under MTF

Execute your transaction as usual, then convert it to MTF by clicking the link sent to you and authorizing it with an OTP before 8 PM on the same day.

Research Assistance

Benefit from specialized research with recommendations tailored for MTF transactions.

How to Maximize Your Margin Trading in India with Us?

Unlock greater trading potential with Integrated's margin funding facility and related services. Here’s how you can leverage your margin trading funding effectively

Initial Credit

You have Rs.25000 credit in your Stock Trading A/c.

Opt for Margin Trading

Choose our Margin Trading Funding to enhance your trading in India capacity.

Get Enhanced Funding

Integrated provides an additional Rs. 75,000 in margin funding.

Amplify Your Position

With a total of Rs. 1 lakh, you’re able to take a position 4 times larger than your initial funds.

Stocks Made Simple with MTF

Experience Greater Leverage: Margin Trading Facility Explained

The Margin Trading Facility or MTF is a service for investors that enhances their trading power through borrowing of funds from one of the best MTF brokers in India wide. With MTF in trading, investors can buy stocks beyond what they have capitalized on and this means an opportunity for increased profits.

Key Benefits

Leverage Your Trades

Amplify your trading capacity with borrowed funds

Broad Coverage

Access funding for over 500 margin trading options in the market

Cost-Effective

Enjoy low annual interest charged on margin trading and no extra fees

What is Pay Later (MTF)?

Pay Later (MTF) on margin trading in stock market allows you now trade and pay later. You can use this margin funding instead of paying for full cost upfront and settle at later dates. This flexibility increases liquidity therefore you can focus on trading leaving aside immediate financial burden.

- Flexible Payments: Trade now and pay at your convenience

- Improved Liquidity: Keep more of your capital available for other opportunities

- Focused Trading: Avoid immediate financial constraints and concentrate on your trades